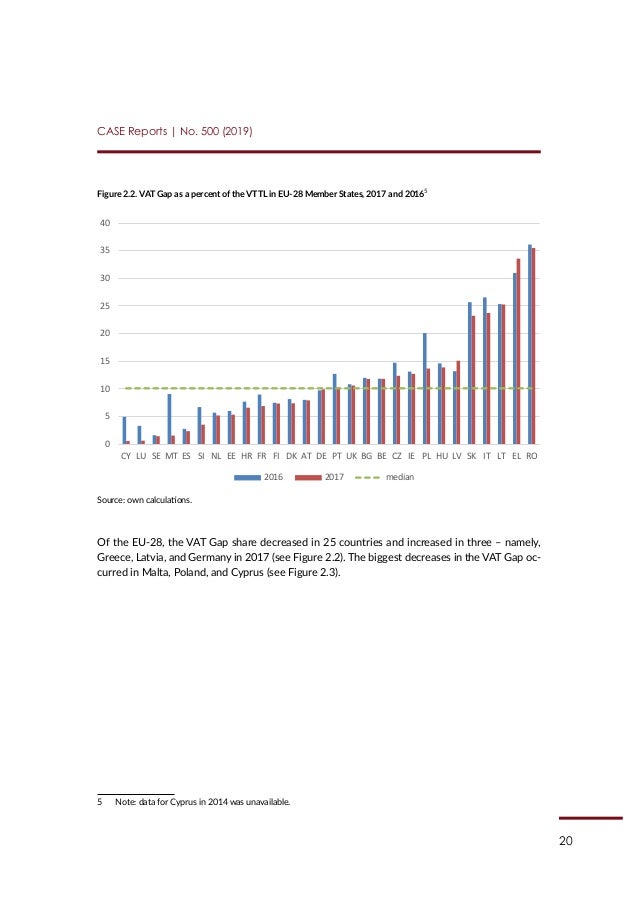

VAT non-compliance costs in Europe fell to €160 billion - CASE - Center for Social and Economic Research

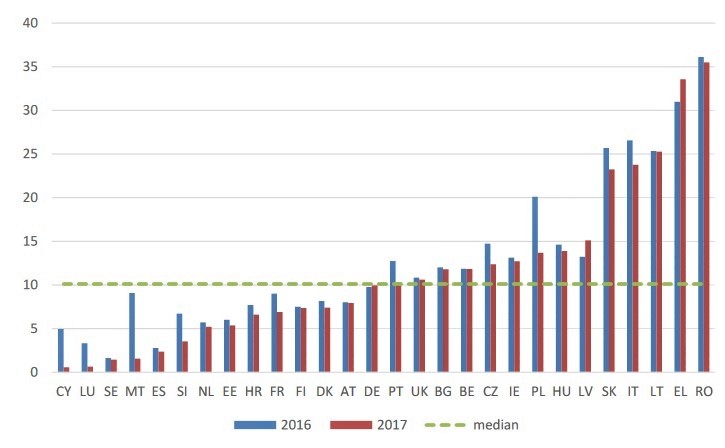

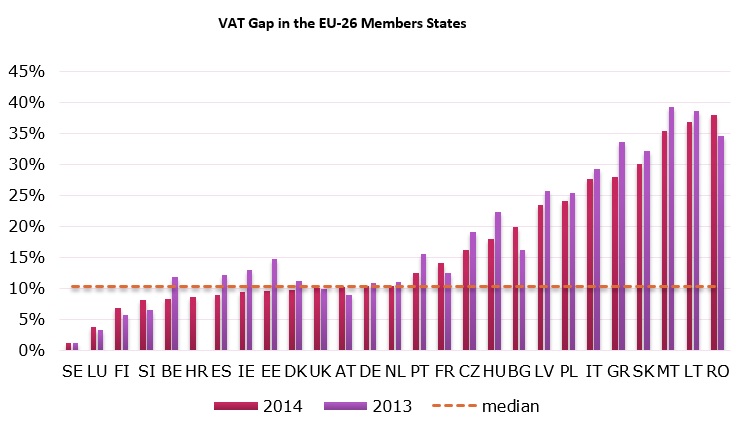

The VAT gap in the Central and Eastern European countries (as a percent... | Download Scientific Diagram

European Commission 🇪🇺 on Twitter: "EU countries lost almost €150 billion in #VAT revenues in 2016, according to our new study. They have been reducing this 'VAT Gap', but a substantial improvement