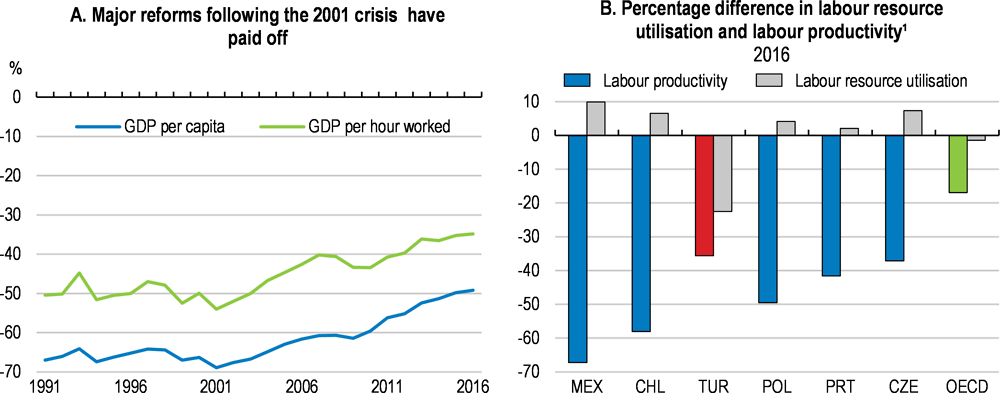

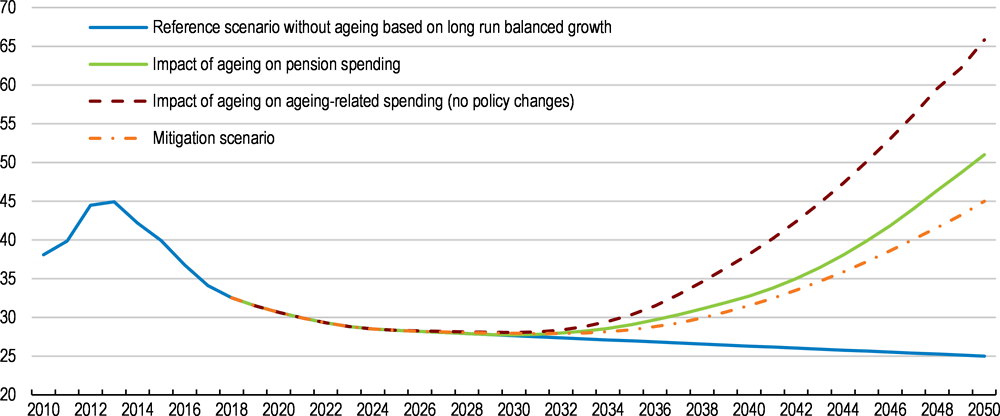

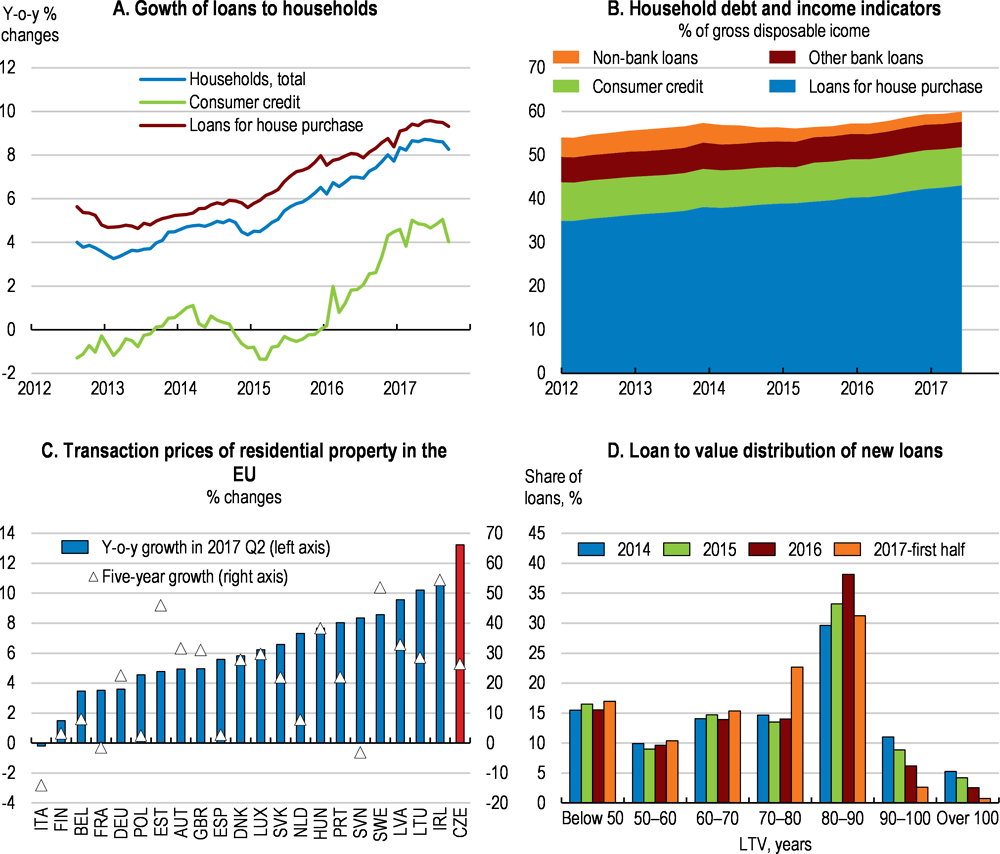

Czech Republic: Staff Report for the 2016 Article IV Consultation : Czech Republic : 2016 Article IV Consultation-Press Release; Staff Report; and Statement by the Executive Director for Czech Republic:

Sustainability | Free Full-Text | Is the Value Added Tax System Sustainable? The Case of the Czech and Slovak Republics | HTML

Republic of Poland : Republic of Poland : Technical Assistance Report-Revenue Administration Gap Analysis Program-The Value-Added Tax Gap:

Before We Close Tax Gaps, We Have to Understand Them - CASE - Center for Social and Economic Research

6: VAT gap as a share of potential VAT liability hypothesis with and... | Download Scientific Diagram

Republic of Poland : Republic of Poland : Technical Assistance Report-Revenue Administration Gap Analysis Program-The Value-Added Tax Gap: